An automated CLMM trading bot that opens concentrated liquidity positions on Meteora DLMM for a specific trading pair, then hedges the open exposure on Hyperliquid to stay delta-neutral. Built for live deployment, it features a single-transaction close-and-reopen flow for positions, a high-speed Redis cache, gRPC data feeds, and custom tweaks to Meteora’s node_modules for extra speed. I cut the full cycle from ~15s to ~1s end-to-end. It’s fully parameterized for quick rollout to new pairs and ships with a Telegram notification system for real-time ops.

Technologies Used:

Backend: Node.js, web3.js

Caching Systems: Redis

Data Stream : Solana gRPC

Key Features:

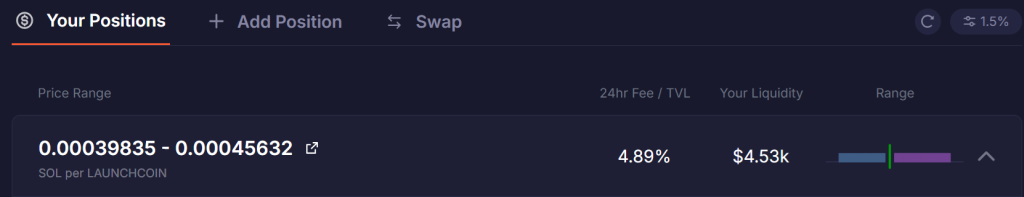

Automated CLMM Liquidity: Opens and manages concentrated liquidity positions on Meteora DLMM for specific trading pairs.

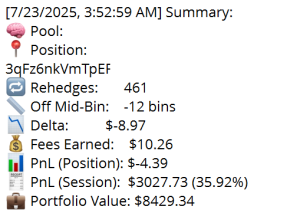

Delta-Neutral Hedging: Hedges open exposure on Hyperliquid perps to keep portfolio delta near zero.

Single-Transaction Rebalancing: Closes and reopens positions in one atomic transaction to reduce price risk.

Ultra-Low Latency: Optimized with Redis caching, gRPC data feeds, and custom node_modules tweaks, cutting cycle time from ~15s to ~1s.

Fully Parameterized Strategy: Easily adaptable to deploy on different pairs without code changes.

Maker-Style Hedges: Posts limit orders just inside the spread to minimize taker fees and slippage.

Cost-Efficient Execution: DLMM ops cost only ~0.000012 SOL/tx, with funding and slippage budgets enforced.

Real-Time Telegram Alerts: Live portfolio summaries, PnL, delta, and event notifications.

Safety Mechanisms: Circuit breakers, stale-data guards, and RPC fallback logic for reliable uptime.